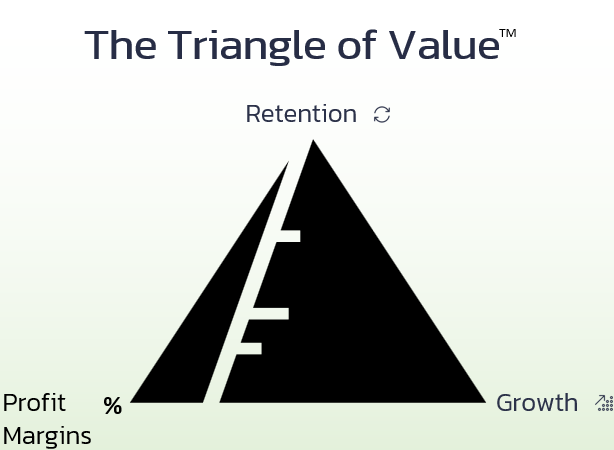

The “Triangle of Value” — The 3 Metrics Buyers Care About Most

When I talk to agency owners about M&A, I share a simple framework I call The Triangle of Value.

It’s built on 3 metrics every serious buyer obsesses over:

1️⃣ Retention – High retention = recurring, predictable cashflow.

2️⃣ Growth – More growth = more cashflow, especially at scale.

3️⃣ Profitability – Obvious, but worth saying: profitability drives cashflow.

The question I get most often is: “Which one matters most?”

Answer: All of them.

Why? Because most buyers (especially PE-backed) are really buying reliable, predictable, recurring cashflow — and each side of the triangle feeds it.

📊 Here’s the key:

You don’t need all three to be perfect all the time. You do need to measure, manage, and be able to explain your numbers.

– Investing in growth and taking a short-term hit to profitability? Fine — if you can show the impact.

– Pulling back on growth to shore up retention? Also fine — if you have the data to prove it worked.

Yes, buyers look at many other things.

But if you control these three metrics, you’re already a long way toward maximizing your valuation.