How did private equity find me?”

That’s one of the most common questions I get from agency owners.

Here’s the process I use (and I suspect most other buyers aren’t too different):

Step 1: Define the ideal candidate

Here, we set the criteria for agencies that we want to acquire – industry focus, products offered, size, and overall fit.

Step 2: Build the master list

Using various research tools, we create a list of every agency that checks those boxes.

Step 3: Narrow it down

Deep “desktop research” using Google, LinkedIn, customer reviews, referrals and other public and private datasets. We dig into founders, culture, track record, and reputation. This is the most time-consuming step—but also the most important because it helps us make sure that we are reaching out only to the agencies that we believe could be good fits.

Step 4: Outreach

Once we’re confident there’s alignment, we reach out directly to the founders and executive teams to start a conversation.

👉 From the outside, that call or email might look like a generic blast. But in reality, a huge amount of effort has gone into identifying you as a strong fit before we ever hit send.

How Did Private Equity Find Me?

August 27, 2025

The Triangle of Value

August 12, 2025

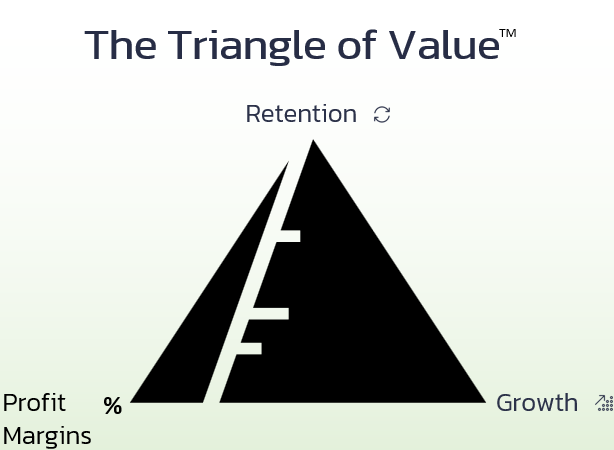

The “Triangle of Value” — The 3 Metrics Buyers Care About Most

When I talk to agency owners about M&A, I share a simple framework I call The Triangle of Value.

It’s built on 3 metrics every serious buyer obsesses over:

1️⃣ Retention – High retention = recurring, predictable cashflow.

2️⃣ Growth – More growth = more cashflow, especially at scale.

3️⃣ Profitability – Obvious, but worth saying: profitability drives cashflow.

The question I get most often is: “Which one matters most?”

Answer: All of them.

Why? Because most buyers (especially PE-backed) are really buying reliable, predictable, recurring cashflow — and each side of the triangle feeds it.

📊 Here’s the key:

You don’t need all three to be perfect all the time. You do need to measure, manage, and be able to explain your numbers.

– Investing in growth and taking a short-term hit to profitability? Fine — if you can show the impact.

– Pulling back on growth to shore up retention? Also fine — if you have the data to prove it worked.

Yes, buyers look at many other things.

But if you control these three metrics, you’re already a long way toward maximizing your valuation.